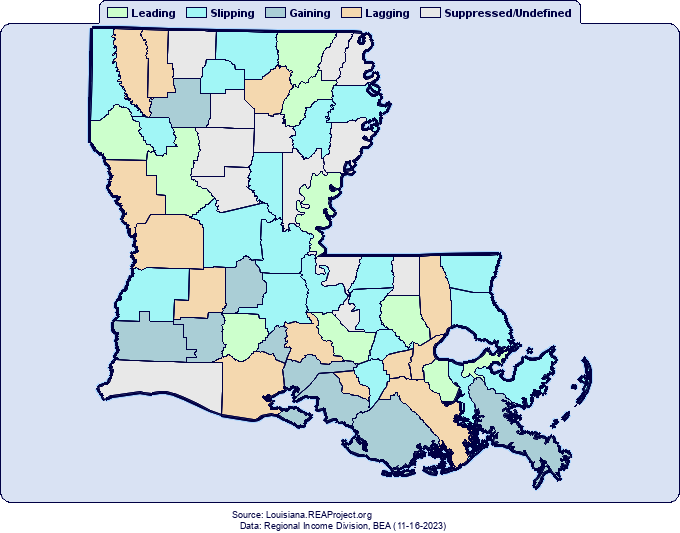

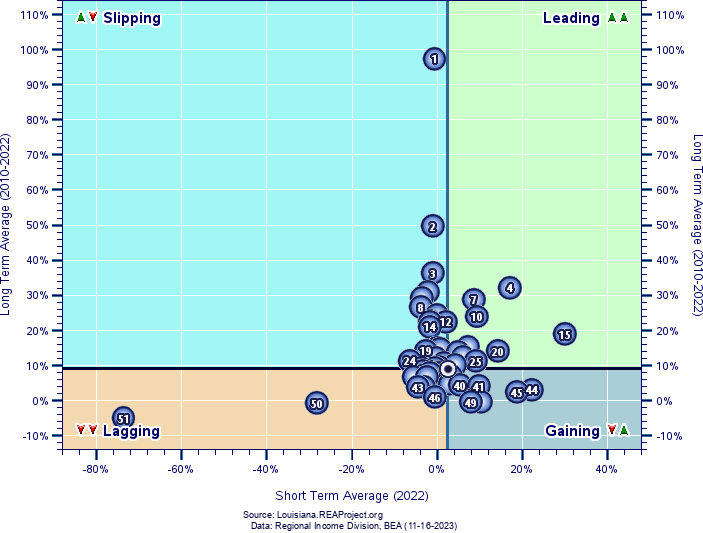

Leading, Slipping, Gaining, Lagging Analysis: Assessing Real Estate and Rental and Leasing Earnings Growth Across Louisiana Counties Real* Real Estate and Rental and Leasing Earnings Growth County vs Statewide Average: 2010-2022 and 2022  Louisiana: 2010-2022 = 9.08% 2022 = 2.45% Borrowing from an approach that sometimes appears in the finance sections of the popular press, LSGL analysis is a handy and versatile way to compare, portray and classify the patterns of real real estate and rental and leasing earnings growth across all of Louisiana's 64 counties. In finance, this technique is used for comparing and assessing the market performance of individual securities or across industry sectors. For example, the performance of the 30 stocks contained within Dow are compared with one another over the past week in contrast to their performance over the past month using the Dow's respective averages as the points of reference. Here in this Louisiana Regional Economic Analysis Project report, we adopt this approach to gauge and compare the real real estate and rental and leasing earnings growth of Louisiana's 64 counties over the latest available year (2022) against the backdrop of their growth over the long term period (2010-2022). In so doing we classify their growth and performance into 4 broad categories: Leading, Slipping, Gaining and Lagging. Real* Real Estate and Rental and Leasing Earnings Growth County vs Statewide Average: 2010-2022 and 2022  Louisiana: 2010-2022 = 9.08% 2022 = 2.45% This figure displays the 64 counties of Louisiana as dots on a scattergram, with the vertical axis representing the average annual real real estate and rental and leasing earnings growth rate over the long-term period (2010-2022), and the horizontal axis representing the real real estate and rental and leasing earnings growth rate for the near-term (2022). This figure sets apart those counties whose long-term real real estate and rental and leasing earnings growth exceeded the statewide average of 9.08%, by portraying them in the top two quadrants demarcated at 9.08% on the vertical axis. County whose long-term average annual real real estate and rental and leasing earnings growth rate trailed the statewide average (9.08%) are distributed in the bottom two quadrants. In all, 30 counties surpassed the statewide average over 2010-2022, while 21 counties fell below. Similarly, the two quadrants on the right of this figure present the positions of the 19 counties whose most recent (2022) real real estate and rental and leasing earnings growth rate exceeded the statewide average (2.45%). The two quadrants on the left feature those 32 counties whose real real estate and rental and leasing earnings growth over 2022 trailed the statewide average. Accordingly, each quadrant portrays the performance of all 64 counties corresponding with their long-term (2010-2022) and near-term (2022) performance relative to their respective statewide averages of 9.08% over 2010-2022 and 2.45% over 2022: Leading counties () (top-right quadrant)...are counties whose average annual real real estate and rental and leasing earnings growth rate surpassed the statewide average both long-term (9.08%) and near-term (2.45%). Slipping counties () (top-left quadrant)...are counties whose long-term average annual real real estate and rental and leasing earnings growth rate exceeded the statewide average (9.08%), but whose near-term growth has "slipped" by falling below the Louisiana average (2.45%). Gaining counties () (bottom-right quadrant)...are counties whose long-term average annual real real estate and rental and leasing earnings growth rate fell below the statewide average (9.08%), but whose near-term growth has "gained" by registering above the average (2.45%) statewide. Lagging counties () (bottom-left quadrant)...are counties whose average annual real real estate and rental and leasing earnings growth rate fell under the statewide average both long-term (9.08%) and near-term (2.45%).

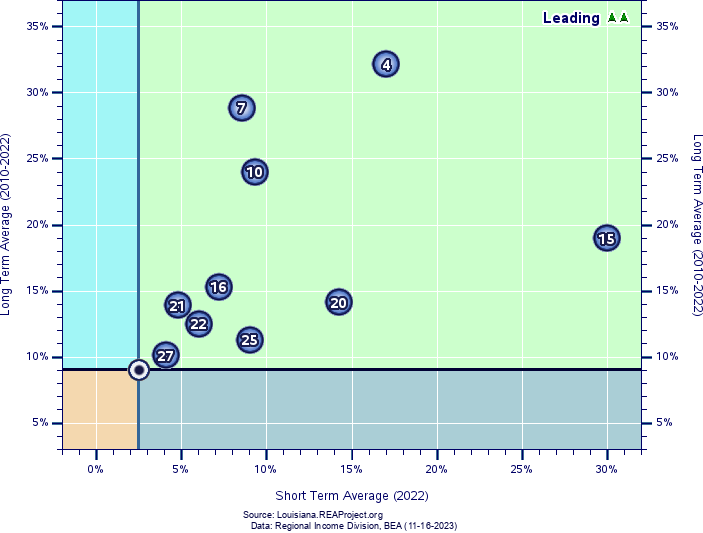

Leading Counties 2022 vs. 2010-2022 Averages  Louisiana: 2010-2022 = 9.08% 2022 = 2.45% Turning attention to the top-right quadrant from the discussion above, this figure features the distribution of the Louisiana counties classified as Leading. These counties surpassed Louisiana's average annual real real estate and rental and leasing earnings growth both long-term (2010-2022 = 9.08%) as well as near-term (2022 = 2.45%). Each is identified by its corresponding ranking based on it's average annual real real estate and rental and leasing earnings growth rate over 2010-2022. Of Louisiana's 64 counties, 10 (16%) are classified within the Leading () category. Those counties ranked by their long-term average include:

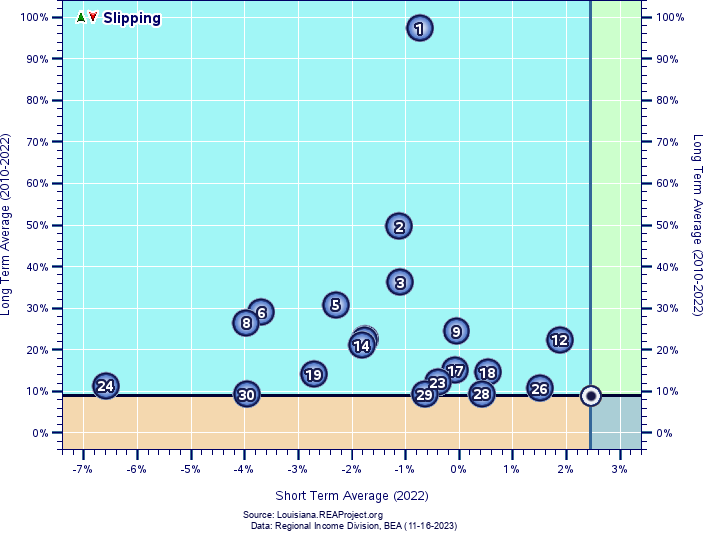

Slipping Counties 2022 vs. 2010-2022 Averages  Louisiana: 2010-2022 = 9.08% 2022 = 2.45% This figure depicts the distribution of the 20 Louisiana counties classified as Slipping (top-left quadrant), in that their long-term average annual real real estate and rental and leasing earnings growth rate outpaced the average statewide (2010-2022 = 9.08%), while they trailed the statewide average near-term (2022 = 2.45%). Again, each county is identified by it's corresponding ranking based on its average annual real real estate and rental and leasing earnings growth rate over 2010-2022. Observe that 20 (31%) of Louisiana's 64 counties are classified as Slipping (). Those counties ranked by their long-term average include:

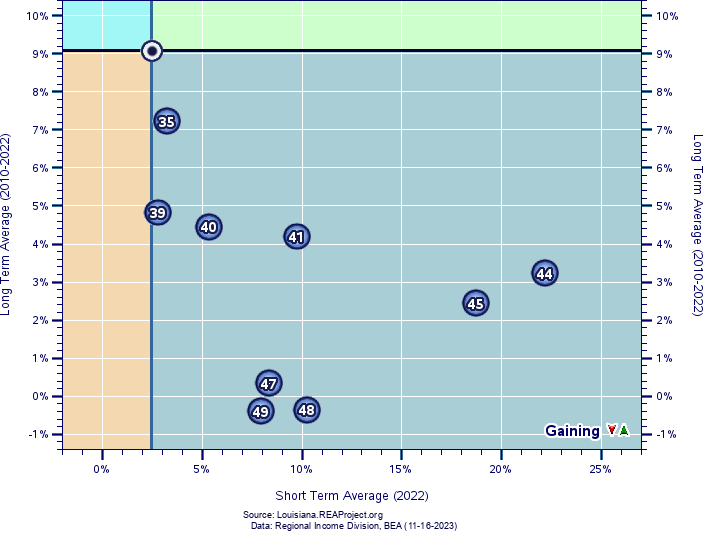

Gaining Counties 2022 vs. 2010-2022 Averages  Louisiana: 2010-2022 = 9.08% 2022 = 2.45% This figure shows the distribution of the 9 Louisiana counties classified as Gaining (bottom-right quadrant), in that their long-term average annual real real estate and rental and leasing earnings growth rate posted below the average statewide (2010-2022 = 9.08%), while they outpaced Louisiana's average near-term (2022 = 2.45%). Again, each county is identified by its corresponding ranking based on its average annual real real estate and rental and leasing earnings growth rate over 2010-2022. Of Louisiana's 64 counties, only 14% (9) are featured as Gaining (). Those counties ranked by their long-term average include:

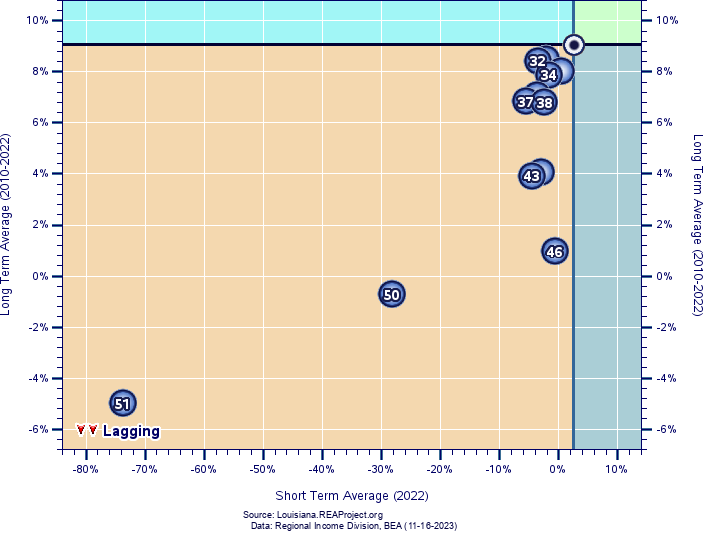

Lagging Counties 2022 vs. 2010-2022 Averages  Louisiana: 2010-2022 = 9.08% 2022 = 2.45% This figure depicts the distributions of the 12 Louisiana counties classified as Lagging (bottom-left quadrant). These counties trailed the statewide average annual real real estate and rental and leasing earnings growth both long-term (2010-2022 = 9.08%) as well as near-term (2022 = 2.45%). Again, each county is identified by its corresponding ranking based on it's average annual real real estate and rental and leasing earnings growth rate over 2010-2022. 19% of Louisiana's counties, 12 of 64, are characterized here as Lagging (). Those counties ranked by their long-term average include:

| Analysis Options Menu | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||